How to trade forex with macd

Rolf Indicators , Price Action , Technical Analysis , Tradeciety Academy 35 Comments 54, Views.

The MACD is a momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. In this article, we will explain what the MACD does, how it helps you analyze price and how to use it in your own trading.

This means that the MACD line is basically a complete moving average crossover system in just one line.

In this article, we focus on the MACD and the signal line in particular. There are 2 MACD signals in particular that we will explore in this article and explain step by step how to use the MACD to find trades:. You can also see that I plotted the two moving averages on the chart and when the two MAs cross, the MACD line crosses 0. As I said earlier, the MACD line is similar to a moving average crossover system and the 0 line cross shows that nicely. As we know from our moving averages article, a cross of 2 MAs shows a change in momentum and often foreshadows the creation of a new trend.

So, whenever the MACD Line crosses 0, it shows that momentum is changing and potentially a new trend is just being created. When you see the two MACD indicator lines move away from each other, it means that momentum is increasing and the trend is getting stronger. When the two lines are coming closer to each other, it shows that price is losing strength.

Trading The MACD Divergence

As long as the MACD lines are above 0 and price is above the 12 and 26 EMAs, the trend is still going on. In the video below, I show this concept in more detail. During ranges, the two lines from your MACD are very close together and they hover around 0; this means that there is no momentum and no strength.

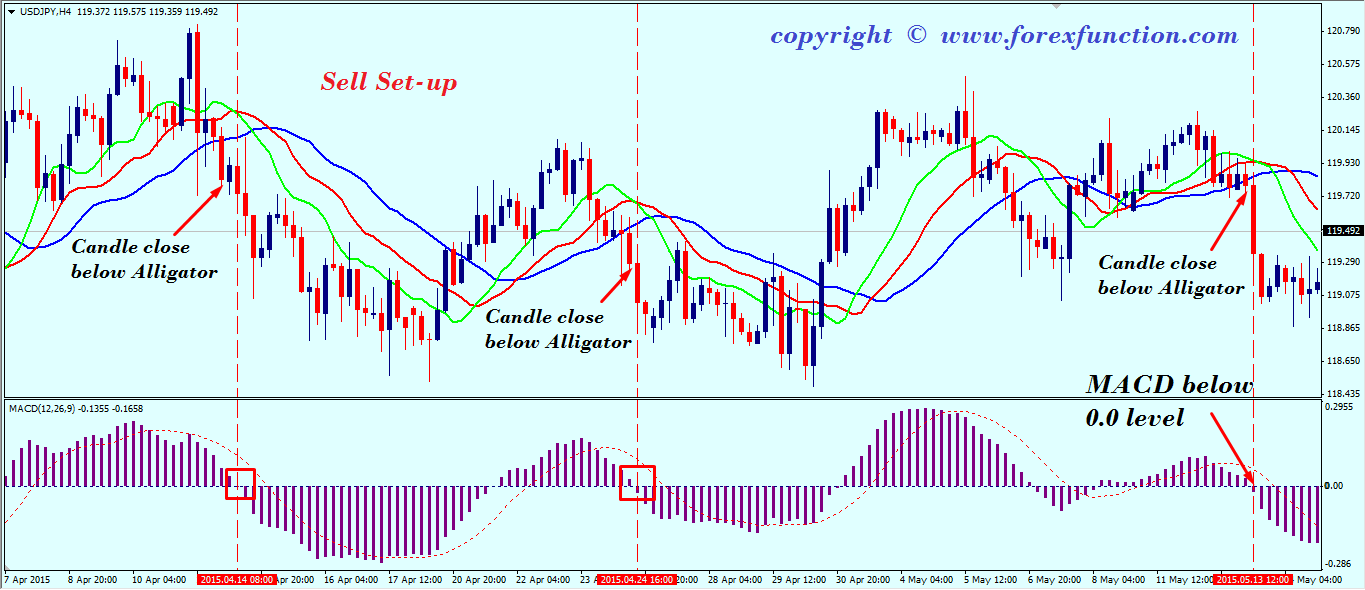

When price breaks out and starts a trend, the two indicator lines pull away from the 0 line and also move away from each other. Then, during a trend, the moving averages can act as support and resistance and keep you in trends. When the price crosses below the EMAS the uptrend is over. The same holds true for downtrends. At the beginning, or during a downtrend, the two indicator lines are pointing down and also show a lot of space between the lines.

MACD - How To Use The MACD Correctly

This shows strong downside momentum. A downtrend comes to an end when price crosses above the moving averages. The screenshot below shows another classic example how the MACD adds context to price movements.

After the trendline break and when price broke the moving averages to the downside, a new downtrend was started.

The MACD then also broke the 0 line and the two indicator lines moved away from each other as the downtrend gained momentum. At the bottom of the downtrend, the MACD showed a divergence, foreshadowing the loss in momentum and the end of the trend. MACD divergences are another great way to analyze price and find early trades. You can see in the screenshot below how price was moving higher very slowly over a long period of time. At the same time, the MACD moved lower showing that there was no buying strength behind the slow grind.

Then, suddenly, price broke below the two moving averages quickly and also the MACD lines crossed below 0 giving a short entry. During the following sell-off, the MACD stayed below 0 and it allowed traders to ride the trend until the very bottom. Traders always ask me whether they should use the MACD or the RSI in their trading!? And although the two indicators are very similar and I prefer the RSI in my own trading, I often suggest using the MACD in the beginning.

The MACD has two major advantages over the RSI which can help new traders make better decisions. First, the two lines of the MACD provide more information and, thus, are often easier to read for new traders. Secondly, the 0 line cross is a very objective signal and there is little room for interpretation.

Thus, if you are a new trader, looking for a good momentum indicator, I suggest going with the MACD. It just comes down to how you use them. Indicators are great trading tools which offer objective and easily to interpret information.

In the case of the MACD, the indicator is ideal when it comes to analyzing momentum and also finding new trends. Thanks for your very informative post on MACD. There is no right or wrong. It comes down to the application. You have left out the MOST important component of the MACD indicator. This shows that you do not actually know this indicator or how to use it as claimed. Hi sir, This is very informative articles specially on newbie like me and has a day job.

So precise to decide when to make an entry…thank you so much..

Having said that, I mostly trade the 4H charts. Nice, easy explanation of MACD. Hello James, I wrote about my weekly process in detail here: How to detect the false divergences and how to findout the legitimate ones. Because most of the times, we find divergences and expect reversals, but it keeps on going in the same direction with same divergence.

Hughes Optioneering

So how o avoid fake divergences and detect the legitimate divergences. Can you shed some light on how to go findout the legitimate ones? Often times daily and 4h timeframes indicate quite opposite things, e. Which timeframe in this case we should rely on more?

On the higher TF, I just want to get the direction, important key levels and price action confirmation. Great Information Wolf… do you ever consider using the MACD in conjunction with the RSI? I am a newbie, I am just trying to if and how some of these indicators can complement eachother… thanks for anything you can add… again, great article. Thanks a lot for your insights. This helps a ton. Just today I found this site, precisely looking for information related to macd.

I just read the article and I found it quite useful and very well explained apologies for my poor English. I would like to ask you, if this macd configuration, and the concepts explained in the article, can also be used for stock trading.

The real power of indicators comes from the way the trader interprets the information and puts it into context. How can I get the red and green shaded area on the MACD on TradingView?

I have 12,26,close,9,etc but how can I get the black line on the 0. Thank you sharing this MACD setting. I am new in the Forex Trading Industry and I have been searching for a very simple strategies and setting of MACD that can be easily understood so that I can use in order to have a sure winnings and less losses. It is very useful for a starter to adopt your strategy and it is one of the most understandable methods so far.

Thank you in advance. I recommend you stick to the default setting and start observing the MACD in combination with price action. Your email address will not be published.

How to Use the MACD Indicator - idonayojujid.web.fc2.com

Trading Resources Tradeciety Academy About us Contact Webmasters. Tradeciety — Trading tips, technical analysis, free trading tools Forex Trading Blog And Trading Academy. Trading Blog Technical Analysis Market Analysis Indicators Price Action Psychology Beginners Risk Management Statistics Tips Premium Courses Member Login My Courses Member Forum Become A Member. MACD — How To Use The MACD Correctly Rolf Indicators , Price Action , Technical Analysis , Tradeciety Academy 35 Comments 54, Views.

Contents in this article The basics of the MACD indicator Trend- following entry scenario 1 MACD trade entry Example 2 MACD divergences as early entries MACD vs RSI — which momentum indicator should you pick?

Forex Trading Academy Forex price action course Private forum Weekly setups Apply Here. Rolf May 17, at Joe May 17, at Rolf May 18, at Thomas Bradley October 7, at Rolf October 9, at 5: Aaron May 17, at 2: SINGH June 16, at 3: James June 28, at 8: Rolf June 29, at 8: James July 26, at Rolf July 27, at 9: OKK November 2, at 2: Rustam November 4, at 5: Rolf November 5, at 1: CodeSociety December 6, at 6: Rolf December 6, at 2: Kris December 29, at 1: Rolf December 29, at 9: Israel January 13, at Rolf January 14, at 1: Sandrine February 9, at 6: Rolf February 11, at 5: Ashit Amin March 7, at 4: Rolf March 8, at 5: Gavin April 19, at 5: Rolf April 19, at 2: Leave a Reply Cancel reply Your email address will not be published.

We are Rolf and Moritz. We have a passion for trading and sharing our knowledge. We travel the world and hope to inspire. We quit our corporate jobs a few years ago and are now living life the way we want it to be.

Our holy grail is hard work and independence. We have a passion for sharing our knowledge of the markets and hope to help other traders improve their trading. Tradeciety Trading Courses About Us Contact us Free Beginner Courses. Trading Futures, Forex, CFDs and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results. Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice.

Full Terms Image Credit: Tradeciety used images and image licenses downloaded and obtained through Fotolia , Flaticon , Freepik and Unplash. Trading charts have been obtained using Tradingview , Stockcharts and FXCM. Icon design by Icons8. Imprint Privacy Policy Risk Disclaimer Terms. Enter your email and get instant access. Please share to spread the word Facebook Twitter Email. We use cookies to ensure that we give you the best experience on our website. The continuous use of this site shows your agreement.

Privacy Policy I accept.