Hedge currency exposure with options

In the loop Nov 23, Currency volatility over the past 24 months has made CFOs take notice of the swings in their reported earnings.

Giddy: Myths About Foreign Exchange Options

Companies that previously did not actively manage their currency risks are considering doing so, and others who managed these risks using plain-vanilla instruments are investigating more exotic currency risk management programs.

What does all of this mean for their accounting? Hedge accounting can reduce income statement volatility resulting from certain foreign currency risks, including those arising from foreign-currency-denominated assets and liabilities and forecasted transactions, such as anticipated sales in foreign currencies. Before beginning or expanding a hedging program, companies should inventory the source and nature of their currency risks i.

Companies that are just beginning to actively manage their currency risk often use simple forward contracts as their primary hedging tool. Forward currency contracts obligate the company to buy or sell currency at a fixed price at a specified date.

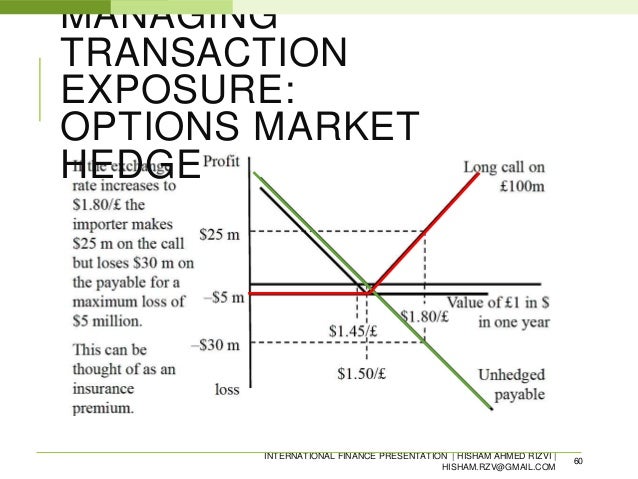

Options give companies the right, but not the obligation, to buy or sell currency at a fixed price for a specified time period. Options protect companies from unfavorable currency movements while enabling participation in favorable currency movements. These benefits come with a tangible cost, as option premiums can be quite costly. To mitigate the cost of purchased options, companies can utilize options strategies that combine purchased and written options. As a result of the volatile foreign currency environment, more companies are turning to options for their increased flexibility.

However, there is a fair amount of administration required to achieve hedge accounting, which is often in proportion to the complexity of the strategy. The guidance on hedging is quite rigid and can be onerous. Risk management strategies that use only forward contracts may qualify for reduced administration, but programs with option strategies often require more administration, including robust systems that are capable of performing complex mathematical computations — and all of this requires experienced staff with the requisite knowledge.

Depending on the currency and complexity of a derivative, companies may find it challenging to estimate its fair value. The valuation may require use of a pricing service.

These estimates are still necessary even if, as a result of hedge accounting, most of the change in fair value is recorded in other comprehensive income. Companies considering more complex risk management strategies will need to weigh the cost and the benefit of more flexible, but potentially costly, option strategies compared with more rigid, but potentially simpler, forward-based strategies.

Although neither approach is without cost or administration, there are pros and cons to each. The FASB is expected to propose amendments to several aspects of the current hedge accounting guidance in early Tentative decisions to date would relax the timing of the initial documentation of effectiveness and eliminate the need for subsequent quantitative effectiveness testing unless facts and circumstances in the hedging relationship change.

While many believe these changes would be helpful, the final standard may not be available for at least a year.

US Strategic Thought Leader, National Professional Services Group. Managing Director, National Professional Services Group, Florham Park. Our guide describes in detail the financial statement presentation and disclosure requirements of common balance sheet and income statement accounts. Our guide provides our insight into the accounting for derivative instruments and hedging activities under US GAAP. Foreign currency volatility is impacting companies across all industries. In this webcast, foreign currency professionals from PwC's National Office and the Capital Markets Accounting Advisory Services practice discuss key considerations for multinational companies with foreign operations regarding the impact that acquisitions and dispositions can have on functional currency determination, recording of goodwill, release of CTA and substantial liquidation of foreign entities.

Participate in the on-demand CPE-eligible version of this webcast.

Our guide provides a framework and specific examples of how to account for foreign currency transactions and foreign operations. Beth Paul US Strategic Thought Leader, National Professional Services Group Email. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

Each member firm is a separate legal entity. Share FB twitter Linkedin. Cyprus South Africa Estonia Finland Hungary Gibraltar Trinidad and Tobago Macedonia Nigeria Cayman Islands Caribbean Pakistan Equatorial Guinea Mongolia Portugal Channel Islands Sri Lanka Armenia Maldives Ecuador Croatia India Moldova Vietnam South Korea Czech Republic Netherlands Kazakhstan Philippines Indonesia Greece Turkey Norway PRTM Japan Hong Kong United Kingdom UK Cambodia British Virgin Islands Netherlands Antilles Brunei Zimbabwe Costa Rica Iceland United States US USA U.

Guatemala Serbia Luxembourg Mauritius Chile Isle of Man Australia Belarus Germany. CFOdirect Issues Publications Industries Standard setters Webcasts, videos and podcasts Events. Explore PwC Services Industries Careers About us Research and insights PwC Open University.

PwC describes strategies and the associated accounting implications for hedging foreign currency risks. What you need to know about foreign currency Due to recent currency volatility, more companies are hedging their foreign currency exposures. Forward contracts can be an effective way to hedge foreign currency exposures.

Option strategies have become more popular as they allow companies to participate in favorable exchange rate movements without the downside risk of a forward contract. However, they can be more costly and involve more administration. Companies considering more complex risk management strategies should weigh the cost and benefit of the strategies.

Recent volatility in foreign exchange market Currency volatility over the past 24 months has made CFOs take notice of the swings in their reported earnings. Hedge accounting Hedge accounting can reduce income statement volatility resulting from certain foreign currency risks, including those arising from foreign-currency-denominated assets and liabilities and forecasted transactions, such as anticipated sales in foreign currencies.

Currency Option

Hedging foreign currency transactions Companies that are just beginning to actively manage their currency risk often use simple forward contracts as their primary hedging tool. Derivative used to hedge foreign currency exposures Pros Cons Forward contract Easier administration Lower initial cost than options Results known at inception Rigid Strike price must be honored even if the market moves against the company Purchased option No downside risk Premiums can be costly Harder to administer hedge accounting than for forwards Combination of purchased options and written options Premium received on written options offsets premium paid on purchased options Downside risk can be managed More difficult administration than forwards.

New hedge accounting proposal expected The FASB is expected to propose amendments to several aspects of the current hedge accounting guidance in early How PwC can help To have a deeper discussion about foreign currency hedging at your company, please contact: Horan Managing Director, National Professional Services Group, Florham Park Email.

Financial statement presentation Our guide describes in detail the financial statement presentation and disclosure requirements of common balance sheet and income statement accounts. Derivative instruments and hedging activities Our guide provides our insight into the accounting for derivative instruments and hedging activities under US GAAP.

Foreign currency volatility Foreign currency volatility is impacting companies across all industries. Foreign currency considerations in acquisitions and dispositions In this webcast, foreign currency professionals from PwC's National Office and the Capital Markets Accounting Advisory Services practice discuss key considerations for multinational companies with foreign operations regarding the impact that acquisitions and dispositions can have on functional currency determination, recording of goodwill, release of CTA and substantial liquidation of foreign entities.

Foreign currency Our guide provides a framework and specific examples of how to account for foreign currency transactions and foreign operations.

Sign up for our weekly news and alerts. Contact us Beth Paul US Strategic Thought Leader, National Professional Services Group Email. Featured topics Business combinations Consolidation and equity method Fair value measurement Financial instruments and hedging Foreign currency IFRS in the US Income tax Insurance contracts Lease accounting Not-for-profit accounting Pension accounting Private company accounting Revenue recognition Stock compensation Year-end financial reporting.

Industries Asset management Automotive Banking and capital markets Communications Energy and mining Entertainment and media Financial services Health industries Industrial products Insurance Private equity Power and utilities Private company industries Public sector Retail and consumer Technology.

Webcasts, videos and podcasts Webcasts On-demand CPE Podcasts Videos. Standard setters AICPA CAQ COSO EITF FASB GASB IASB PCAOB SEC. About CFOdirect Newsletter signup Financial reporting blog Events Resources Contact us.

3 Ways to Hedge Currency - wikiHow

Privacy Legal Site provider Site map. Easier administration Lower initial cost than options Results known at inception. Rigid Strike price must be honored even if the market moves against the company. Premiums can be costly Harder to administer hedge accounting than for forwards. Premium received on written options offsets premium paid on purchased options Downside risk can be managed.