Taxes on covered call options

When I sell call options based on an underlying security that I own covered call writing , how are the proceeds treated fro tax purposes?

The Perpetual Covered Call As A Tax Advantaged Trade | Seeking Alpha

As a short-term capital gain? Is taxation of the option proceeds affected by how long I've held the underlying stock, and whether I ultimately sell it at a profit or a loss, or are these unrelated transactions?

The tax comes when you close the position.

There's a short-term capital gain for the difference between your short-sale price and your buyback price on the option. I believe the capital gain is always short-term because short sales are treated as short-term even if you hold them open more than one year.

If the option is exercised calling away your stock then you add the premium to your sale price on the stock and then compute the capital gain.

So in this case you can end up treating the premium as a long-term capital gain. See IRS pub http: Successful covered calls are short term capital gains. The amount of time you have owned the underlying security is irrelevant. The gain occurred in the option period which will be an amount of days less than needed for a long term capital gain classification.

Failed Covered calls can be either as the date you acquired the stock you are forced to sell determines their classification. By posting your answer, you agree to the privacy policy and terms of service.

TMF: Covered Calls and Taxes / Options - You Make the Call

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges.

Questions Tags Users Badges Unanswered. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top.

How are proceeds from writing covered calls taxed?

Tony the Pony 2, 1 19 Havoc P 6, 16 Why do you suggest that having the stock called away is a fail? It may just be in the money and the seller has still make more of a profit than buy and hold.

united states - How are proceeds from writing covered calls taxed? - Personal Finance & Money Stack Exchange

Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name.

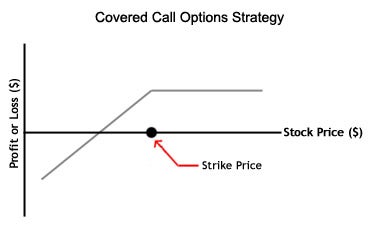

Covered Calls ExplainedMathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.