Eur usd usdchf hedging strategy

I'm a strategists, I enjoy thinking about new trading ideas. I share some of these manual trading strategies freely with no obligations.

French Franc. Money Management | idonayojujid.web.fc2.com

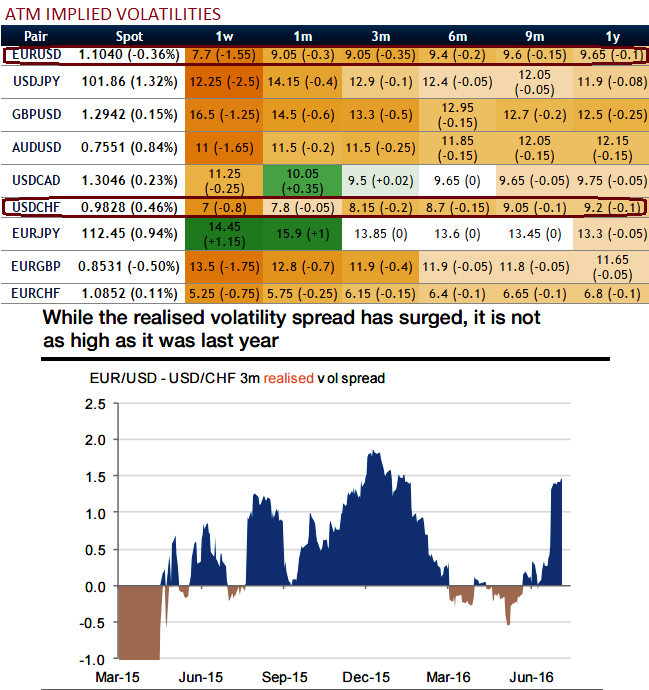

My primary focus is in developing automated trading robots. I commit a percentage of all income to charity-causes. Trading of any form is a high risk activity. Do not proceed if you are not already a trader. While resting by the beach a few days back, this idea came to me. USDCHF and EURUSD are highly inverse-correlated currency pairs. This means their price moves very similiarly mirror like , but in opposite direction see picture.

Many have explored the possibilities of doing cross currency interest arbitrage with these pairs, but with no success hey, there are no free lunch. However, few have explored the potential of "Averaging Volatility" strategy on this pair. To make it more interesting, I'd throw in another highly lucrative income for the IBs Introducing Brokers -- IBs will love me for this post: Before we get into the details, I'll do some technical explaination.

If all these doesn't interests you, skip all the way to the bottom SUMMARY.

In other words, these pairs can be used for hedging purposes. The scenario that causes the price to deviate from the correlation mirror-like movement is called volatility. Volatility comes and volatility goes. When an economic data release happens say in EUR , volatiltiy spike, causing a discrepancy in the pricing. Usually, due to higher liquidity, EURUSD tends to lead the movement first. And after a while, once the market have absorbed the "shock", things goes back to normal efficient market , and volatility subside.

The idea that I have is to average out these volatility. At random, say once every couple of hours, we would open a hedged pair, USDCHF and EURUSD. Because they are inversely correlated, they can be considered as hedged cross currency.

Initially, when you first place a trade pair, you should have a loss; due to spread and commission. Here are the steps:.

When closing, make sure you close the profitable trade FIRST, follow by the loosing trade. Any floating loss you have would be limited because the 2 currency pairs are inversely-correlated mirror like movement. When 1 trade makes money, the other would loose money. Overall, we need to factor in the spread, commission and swap. So, initially, it would be a loss. But wait for some time a day or two and after averaging off the volatility, there would be scenarios where the 2 pairs would move in tandom due to news and volatility and you will realize a profitable scenario.

Obviously, we won't get perfect scenarios all the time.

That beats most "investment vehicles" out there in the market. And you are in control of your funds. Like any TV sales advertisement, there is always a "but wait As IBs, every transaction turn-over that happens, they earn a rebate. Depending on the broker, and the IB's volume, the rebate can be anything from 0. Now, this " Volatility Averaging Hedge Strategy " for lack of any creativity in giving it a name would generate ALOT of volume.

USDCHF - Hedging Strategy of the Week (Profit Target: Pips)

So, IBs would love this strategy as it will create a lot of income for them. There are not that many strategy out there that could generate this amount of volume without killing-off the traders very quickly.

This is method is NOT tested.

Because it is cross-currency, I cannot run backtest on it. I have just put this idea to trial after coming back from my vacation. So far, it seems to be OK y. I will try this out a bit more and provide more updates. And of course, I would appreciate any constructive feedbacks from everyone. I strongly discourage people to trade with money that they cannot afford to loose.

But if you have some spare cash and time, and wants to "explore a bit", here's a link for you to open an account: Remove To help personalize content, tailor and measure ads, and provide a safer experience, we use cookies. By clicking or navigating the site, you agree to allow our collection of information on and off Facebook through cookies. Learn more, including about available controls: Join or Log Into Facebook.

July 31, at 3: SUMMARY TRADING IDEA The idea that I have is to average out these volatility. Here are the steps: Randomly over a few hours. Randomly a few hours. Randomly a few hours again and repeat at 3 above. If all trades are closed, wait for an hour or so, and repeat at 1. NOT FULLY TESTED This is method is NOT tested.

Trading Strategies: Forex Trading CorrelationsAbducting Little Green Men at Mars. Notes by Joseph Lee. Sign Up Log In Messenger Facebook Lite Mobile Find Friends People Pages Places Games Locations Celebrities Marketplace Groups Recipes Moments Instagram About Create Ad Create Page Developers Careers Privacy Cookies Ad Choices Terms Help Settings Activity Log.