Put call parity compound option

A compound option or split-fee option is an option on an option. A compound option then has two expiration dates and two strike prices. Another common business application that compound options are used for is to hedge bids for business projects that may or may not be accepted.

Compound options provide their owners with the right to buy or sell another option. These options create positions with greater leverage than do traditional options. There are four basic types of compound options: The formulas for compound option parity can be derived using the principle that two portfolios with identical payoffs should have the same price.

Suppose that you purchase a CoC and sell a PoC on the same underlying call option and with the same strike price and time to maturity. The payoff of this portfolio is always the same: If the underlying call's price at the time of maturity is greater than the strike price, you will exercise your CoC and purchase the underlying call at its strike price.

If the underlying call's price at the time of maturity is less than the strike price, the counterparty will exercise its PoC and you will need to purchase the underlying call at its strike price.

Dynamic Hedging: Managing Vanilla and Exotic Options - Nassim Taleb - Google Livres

Thus, there will always be a cash outflow equal to the strike price and you will come into possession of a call option.

The payoff of this portfolio is identical to the first portfolio. You will own a call that is identical to the underlying call above and you also will have to repay the loan balance, which will be equal to the strike price above.

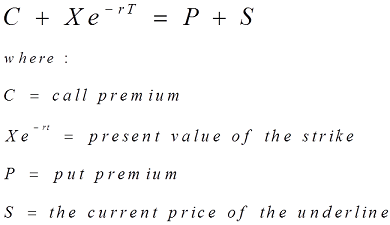

Therefore, these two portfolios must have the same price. Where P indicates price of what's inside the parentheses and PV indicates present value. Similar logic leads to the following:.

FRM: Put call parityFrom Wikipedia, the free encyclopedia. Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.

Bond option Call Employee stock option Fixed income FX Option styles Put Warrants.

Asian Barrier Basket Binary Chooser Cliquet Commodore Compound Forward start Interest rate Lookback Mountain range Rainbow Swaption. Collar Covered call Fence Iron butterfly Iron condor Straddle Strangle Protective put Risk reversal.

Back Bear Box Bull Butterfly Calendar Diagonal Intermarket Ratio Vertical. Binomial Black Black—Scholes model Finite difference Garman-Kohlhagen Margrabe's formula Put—call parity Simulation Real options valuation Trinomial Vanna—Volga pricing.

Put–call parity - Wikipedia

Amortising Asset Basis Conditional variance Constant maturity Correlation Credit default Currency Dividend Equity Forex Inflation Interest rate Overnight indexed Total return Variance Volatility Year-on-Year Inflation-Indexed Zero-Coupon Inflation-Indexed.

Contango Currency future Dividend future Forward market Forward price Forwards pricing Forward rate Futures pricing Interest rate future Margin Normal backwardation Single-stock futures Slippage Stock market index future.

MFE Put Call Parity for Compound options : actuary

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Collateralized debt obligation CDO Constant proportion portfolio insurance Contract for difference Credit-linked note CLN Credit default option Credit derivative Equity-linked note ELN Equity derivative Foreign exchange derivative Fund derivative Interest rate derivative Mortgage-backed security Power reverse dual-currency note PRDC.

Consumer debt Corporate debt Government debt Great Recession Municipal debt Tax policy. Retrieved from " https: Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history.

Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 12 May , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. Terms Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.