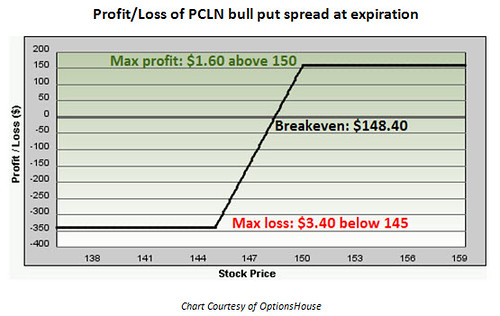

Optionshouse bull put spread

The market this year has been a challenge. The January barometer indicated a bearish market with both the monthly returns and the performance in the first 5 trading days being negative this year.

But as soon as that signal arrived, the market recovered much of the January loss in late February. Now the SPX is actually sitting positive for the year. Before we begin, remember a downside hedge is not designed to eliminate any losses to the downside, if you want to do that SELL YOUR STOCK POSITION!

But rather we think about a hedge as a way to still remain in the market with potential profits should your stock price appreciate but with a way to limit or lessen your potential downside loss. The collar trade is designed to buy a downside put and offset the premium paid by giving up some upside in the stock by overwriting a call option. Put another way, the long Put provides an acceptable exit price at which an investor can liquidate if the stock suffers losses.

The premium income from the short Call helps pay for the Put, but simultaneously sets a limit to the upside profit potential. Long TWTR Stock at To counter this problem, I suggest adding an additional leg to this strategy and creating a put spread collar. Slightly more advanced, this strategy involves selling a further downside put from the purchased put. The benefits of this are twofold.

Spreads - OptionsHouse

You pay less premium for a put spread than a put of course which allows you to move the strike price of the call you will sell more out of the money. This would allow for more upside profit should the stock appreciate.

P1 – Bing Bull Put | Wasatch Trading

Secondly, by selling a further downside put from the put purchased this put spread takes advantage of the negative skew found in the implied volatility levels of downside puts. This is a more advanced topic, but the demand for downside put options causes their prices to command higher volatility premiums.

By selling two options, 1 call and 1 put, and buying only 1 put, you also will turn the theta or decay of the overall strategy positive. The downside of employing the put spread vs. The benefit is we have moved our short call option up to 65 which allows this total trade to be profitable up Since we are presumed to be bullish in the stock we own or we would simply sell to close that stock position, I believe limiting our hedge by way of a put spread and having more potential profitability to the upside with a higher strike call may be compelling.

Remember nothing is free in option trading, you are giving up the upside above 65 in order to limit your loss to dollars to the downside from should the stock fall. Finally even slightly more advanced traders use ratio put spread and put trees to create downside low or no cost downside exposure.

The big more advanced risk associated with this spread type is the downside hedge is effective only to a point and actually can create a bigger problem in a sustained larger move lower. Typically these trades types are done for much shorter terms days to expiration , since you are exposed to a naked short downside put on a stock you are actually looking to hedge. So for very little upfront cost you have mitigating exposure to a downside move immediately from the The put hedge is profitable down to You have unlimited upside exposure because of the long stock above the current price of The put tree is a variation on this strategy.

Again selling 2 puts and buying 1 but the additional put sold is in a lower strike put than the first sold put. This pushes lower the breakeven of the option strategy at the expense of paying more for the put tree than you would for a ratio put spread.

So as I preach, nothing is absolutely free in options trading, but I have given you 3 methods, a basic collar, an intermediate put spread collar and an advanced strategy which can lower or even eliminate the upfront cash expense of providing some downside hedges to a long stock position.

The collars can limit your upside. The ratio and put trees can actually increase your losses to the downside. This article is for informational and educational purposes only and is not intended as trading or investment advice or a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person.

Since I began this series on discussing strategies which take some investment chips off the…. Consolidated Tax Forms are now available in both OptionsHouse platforms. To access your …. The above information is provided by OptionsHouse for informational and educational purposes only and is not intended as trading or investment advice or a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. You are solely responsible for your investment decisions.

Neither OptionsHouse nor any of its employees, officers, shareholders or affiliated companies guarantee the accuracy of or endorse the views or opinions of guest speakers or commentators. Projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature and are not guarantees of future results. Results may vary with each use and over time. Any examples used that discuss trading profits or losses may not take into account trading commissions or fees.

FINRA BrokerCheck reports for OptionsHouse and its investment professionals are available at www. OptionsHouse does not provide investment, tax or legal advice. Options and futures transactions involve risk and are not suitable for all investors. Electronic trading poses unique risk to investors. System response and access times may vary due to market conditions, system performance and other factors.

An investor should understand these and additional risks before trading.

Securities and futures products and services offered by OptionsHouse. Member FINRA SIPC NFA. Log in Open an Account. Need a downside hedge?

But they cost too much — Using option spreads to lower your outright dollar cost. March 13, Steve Claussen Trading Strategies The market this year has been a challenge. Here are a basic an intermediate and an advance strategy that may fit the bill. The Put Spread Collar To counter this problem, I suggest adding an additional leg to this strategy and creating a put spread collar.

Using the put spread collar our TWTR example becomes Long TWTR Stock at Put Ratio spreads and Put trees Finally even slightly more advanced traders use ratio put spread and put trees to create downside low or no cost downside exposure. Steve Claussen Chief Investment Strategist Disclaimer: Tweet Share Plus one Share.

You may also enjoy The market is leaving Apple behind, should you do the same? Take Chips off the table? Using Stock replacement strategies!

Price shocks to the market highlight the benefit of using option exposure. Paying too much in taxes? Maybe an IRA will help. About OptionsHouse About Us Press Releases Awards Careers Affiliate Program. Customer Service Frequently Asked Questions — FAQs Live Chat Live Chat Offline Customer service is available Monday — Friday, 8 a.