Definition of thinly traded stock

Thinly traded stocks tend to go unnoticed by most investors because they are not as popular as other stocks. If a thinly traded stock suddenly catches the attention of investors, even a small increase in demand can trigger large increases in share price. For example, if a stock normally trades only 2, shares per day and a favorable article comes out in a financial journal, demand could soar to more than 10, shares per day.

This sudden demand could drive the price much higher over a period of days or weeks, resulting in large profits for those who held the stock before it became popular.

If someone sells a large percentage of shares in a thinly traded stock, the price is likely to go down because the supply of shares may exceed the demand from buyers. If you intend to accumulate additional shares of a thinly traded stock, you can watch for dips in the price and snatch up shares at a bargain. The same volatility that brought the stock price down can bring it back up, and you can profit from buying when shares are cheaper.

Typically, this buyer will offer a competitive price. Thinly traded stocks tend to be susceptible to desperation selling, so these companies may market your shares discreetly. Roger Ibbotson, professor of Finance at Yale School of Management, says thinly traded stocks do better in the long term than active stocks. He adds that thinly traded stocks need very few traders to move the price, and this means that a steadily increasing demand can help these stocks hold onto their gains.

More active stocks tend to get sold when they rise in price, while people who buy thinly traded stocks tend to hold them because they find few buyers on any given day. This tendency can put upward pressure on the stock over time. Kevin Johnston writes for Ameriprise Financial, the Rutgers University MBA Program and Evan Carmichael.

He has written about business, marketing, finance, sales and investing for publications such as "The New York Daily News," "Business Age" and "Nation's Business.

Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Visit performance for information about the performance numbers displayed above.

Skip to main content. More Articles Effects of Stock Pinning on Option Prices How to Buy Public Stock Dividend Stocks Vs. Stock Market How Do I Day Trade Penny Stocks? Effects of Dividends on Penny Stocks How to Find High Volume Penny Stocks. Potential Short-Term Appreciation If a thinly traded stock suddenly catches the attention of investors, even a small increase in demand can trigger large increases in share price.

What is thinly traded stock? Definition and meaning - idonayojujid.web.fc2.com

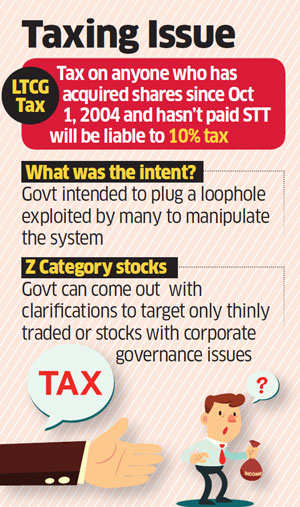

Bargain Prices During Dips If someone sells a large percentage of shares in a thinly traded stock, the price is likely to go down because the supply of shares may exceed the demand from buyers. Above-Average Long-Term Appreciation Roger Ibbotson, professor of Finance at Yale School of Management, says thinly traded stocks do better in the long term than active stocks. Opportunity in Thinly Traded Shares Seeking Alpha: Five Thinly Traded Stocks With Plenty of Upside The Trend Is Blue: Thinly Traded Markets Gold: Buying and Selling Thinly-Traded Stocks.

Thin Stocks Dominate Spotlight, Investors Beware Cherokee Bank: About the Author Kevin Johnston writes for Ameriprise Financial, the Rutgers University MBA Program and Evan Carmichael. Recommended Articles What Is Net Liquid Value in Stock? Can a Stock Price Fluctuate After Hours? Related Articles How to Find the Percent of Share Price to Net Asset Value ETF Vs. Stocks How do I Determine If a Company's Common Stock Still Has Value?

How Does the Back Testing of Stocks Work? Money Sense E-newsletter Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Editor's Picks Day Trading Options in IRA Accounts Day Trading Tips for the New York Stock Exchange Stock Vs. Bond Returns How to Invest in Small Cap Stock How to Report the Sale of Stock Call Options. Trending Topics Latest Most Popular More Commentary.

Thinly Traded Stocks - What Does It Mean?

Quick Links Services Account Types Premium Services Zacks Rank Research Personal Finance Commentary Education. Resources Help About Zacks Disclosure Privacy Policy Performance Site Map. Client Support Contact Us Share Feedback Media Careers Affiliate Advertise.

Tread carefully on thinly-traded stocks - MarketWatch

Follow Us Facebook Twitter Linkedin RSS You Tube. Zacks Research is Reported On: Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.

Logo BBB Better Business Bureau. NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.